Imminent vs Inevitable

Being right about the future, but wrong about timing, is still just being wrong.

The best startup opportunities sit at the intersection of two questions: Is this inevitable? And is it imminent?

Inevitable means directionally correct. Electric vehicles will dominate. AI will transform knowledge work. Healthcare will shift to prevention. These outcomes feel certain.

But inevitable isn't enough. Google Glass was inevitable. So was Better Place. Being right about the future but wrong about timing is still just being wrong.

Imminent means the enabling conditions exist now. The infrastructure is cheap enough. The behavior shift already happened. The regulation just changed. Something made this possible today in a way it wasn't two years ago.

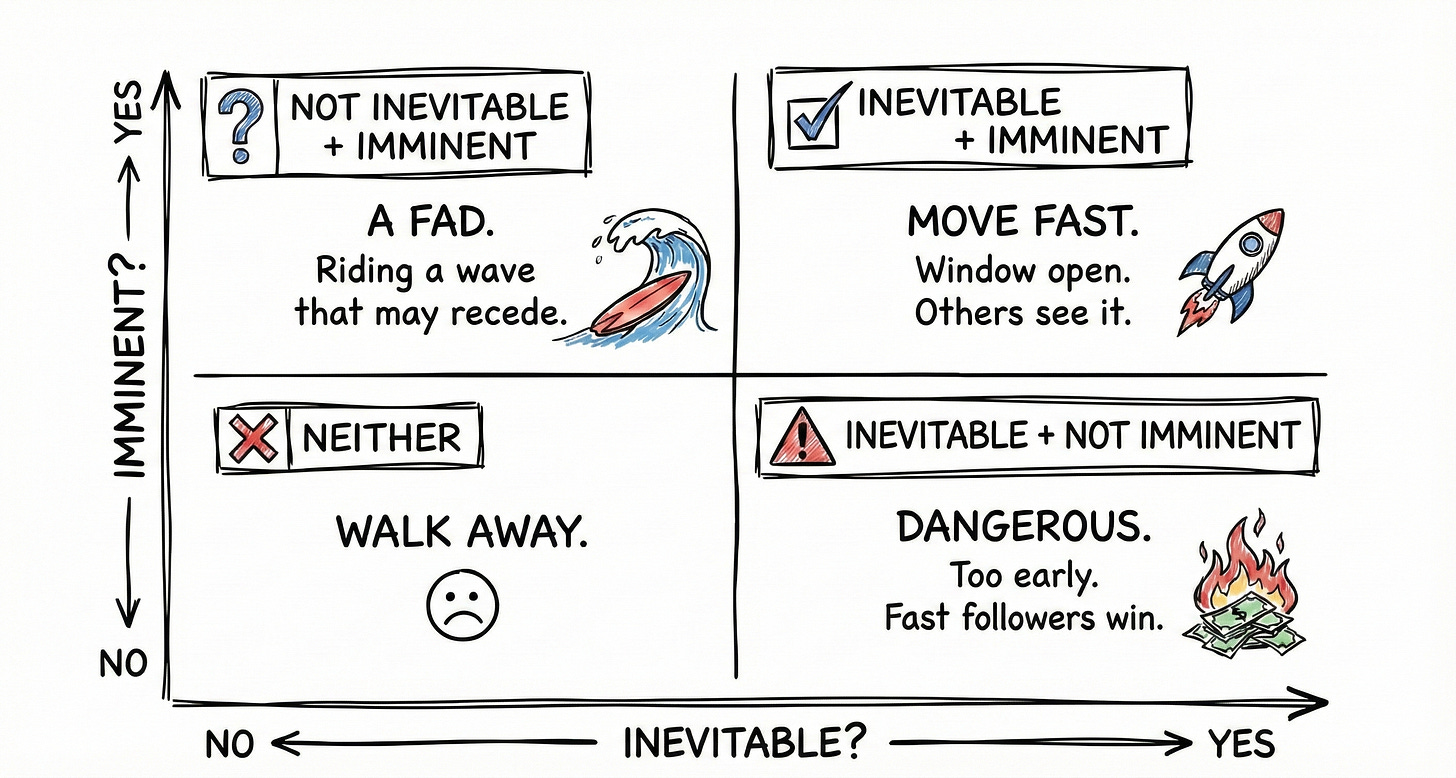

When evaluating opportunities, I think in quadrants:

Inevitable + Imminent: Move fast. The window is open and others see it too.

Inevitable + Not Imminent: Dangerous. You'll spend years educating the market, burn your capital, and watch a fast follower take the spoils.

Not Inevitable + Imminent: A fad. Possible to build a business, but you're riding a wave that may recede.

Neither: Walk away.

The hard part is honesty. Founders want to believe their timing is perfect. Investors want to believe they're early to something big. But "the market isn't ready" is often just "I misjudged this being imminent."

Before you build, ask: What changed that makes this possible now? If you can't answer that clearly, you might be early. And early, in startups, is just another way to be wrong.