Alpha vs Beta Companies

Betting on a trend feels safe, but giant outcomes come from the misunderstood.

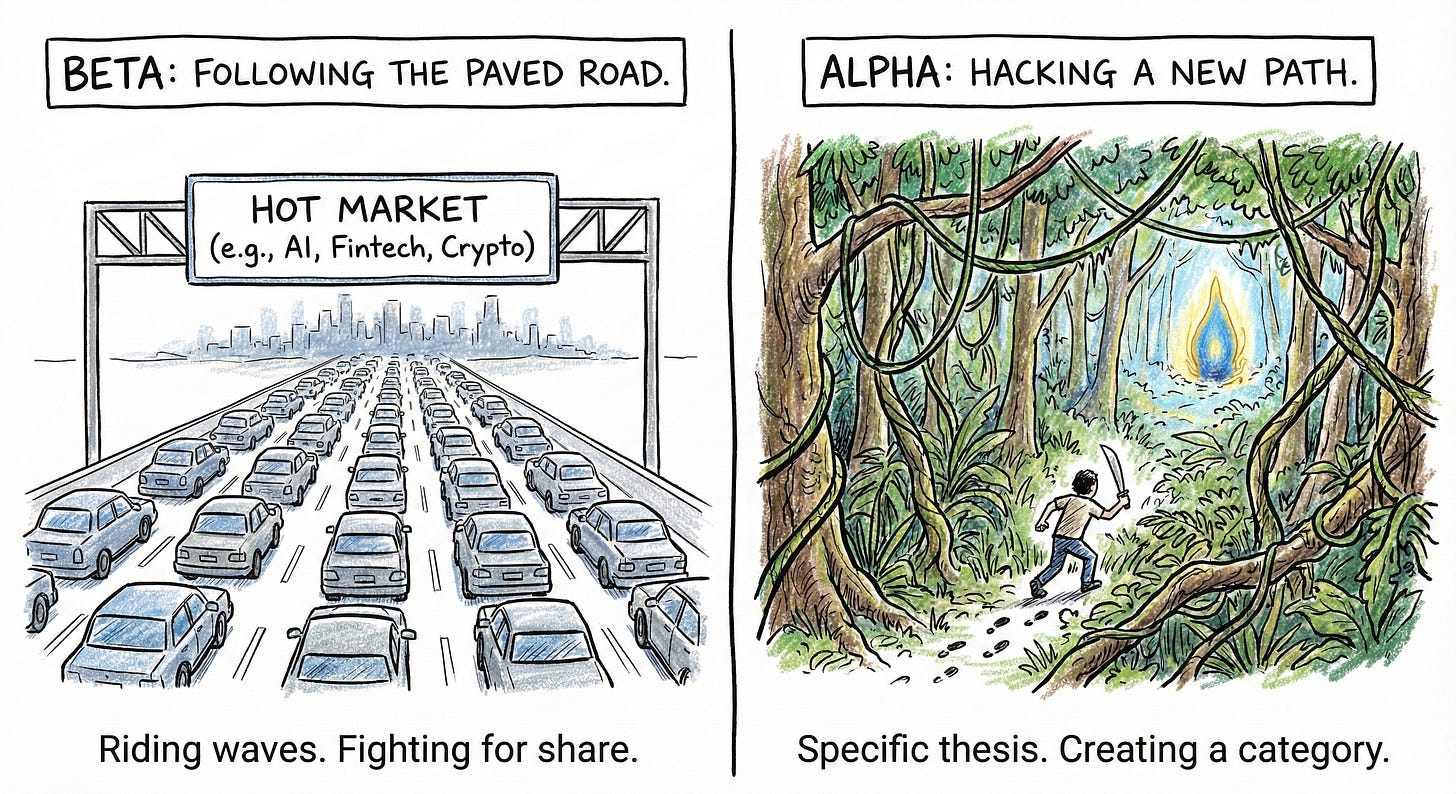

There is a distinction in investing: Alpha vs. Beta.

Alpha investors bet on a specific, contrarian view. Beta investors bet on broad market trends. The same distinction applies to startups.

Beta companies ride waves. AI is hot, so you build an AI company. Fintech is growing, so you build in fintech. The bet is that the market will carry you. You aren’t wrong about the trend. You just aren’t saying anything specific about the future.

Alpha companies aren’t betting on secrets. They are betting on something misunderstood. A capability others think is impossible. A behavior shift others think is niche. You see the same world everyone else does, but you draw a radically different conclusion.

Beta companies get called smart. Alpha companies get called delusional.

SpaceX? Rockets are for governments, not billionaires. Anduril? Defense is blood money. No serious engineer would touch it. OpenAI? A non-profit research lab spending billions on a technology that’s been “ten years away” for sixty years.

Obvious opportunities attract obvious competition. Misunderstood opportunities attract ridicule. Until they attract everything else.

Beta feels safe. But the giant power law outcomes always come from alpha.